in the ever-evolving landscape of cybersecurity, the line between risk management and profit margins can often become blurred. As we look towards Black Hat USA 2025, the question arises: is a high cyber insurance premium a reflection of your association’s risk, or simply a savvy move by your insurer? Let’s delve into the complexities of the cyber insurance industry and explore the factors at play in determining premiums in the digital age.

Navigating the complex world of cyber insurance premiums

as cyber threats continue to evolve,the world of cyber insurance premiums has become increasingly complex. at Black Hat USA 2025, experts discussed whether high premiums are truly reflective of a company’s risk profile, or if they are simply driven by profit motives of insurers. It’s crucial for businesses to carefully evaluate the coverage and terms of their cyber insurance policies to ensure they are adequately protected in the event of a cyber attack. Factors such as the level of coverage, deductibles, and industry-specific risks all play a role in determining the cost of premiums. By staying informed and proactive, businesses can navigate the complexities of cyber insurance premiums effectively.

Understanding the factors influencing your cyber insurance premium

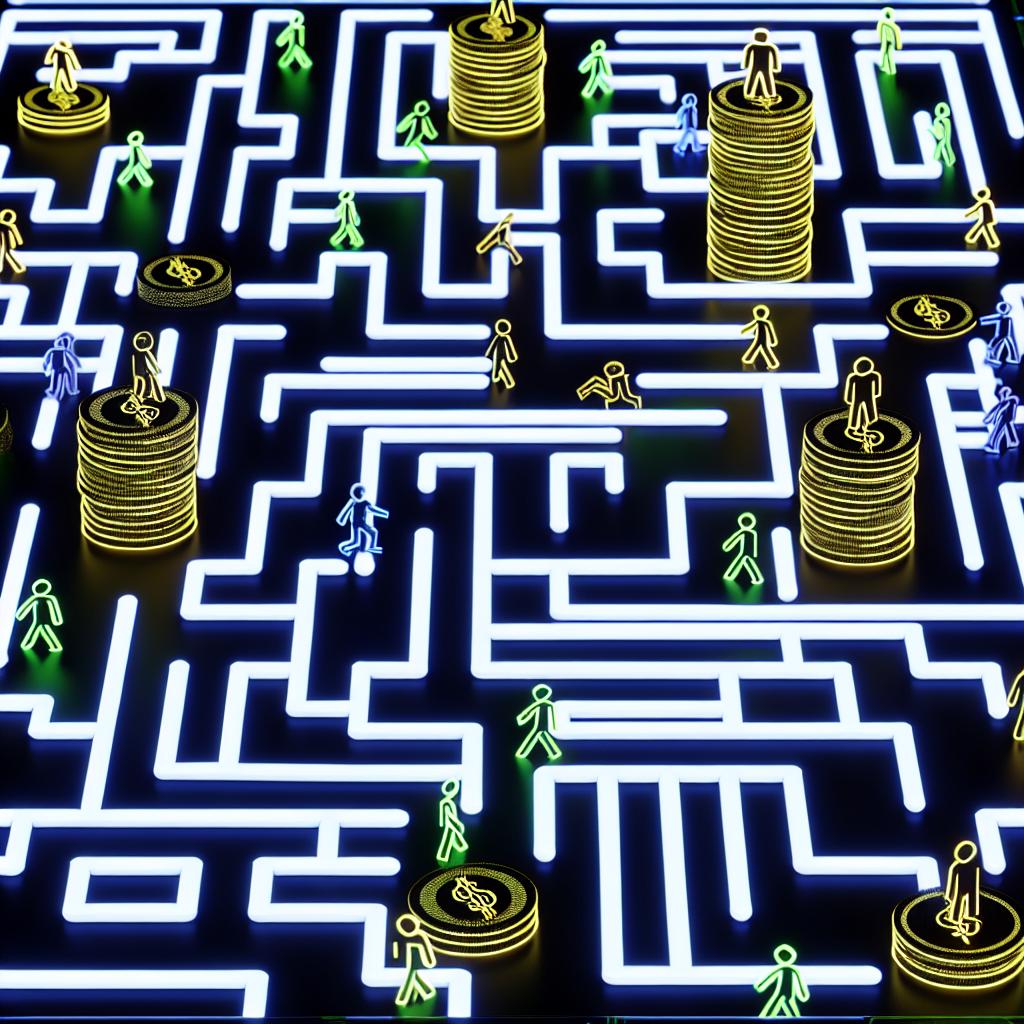

When it comes to , it’s important to consider whether the cost is truly reflective of your risk profile or if it’s more about the insurer’s bottom line. **Cyber insurance premiums can be affected by a variety of factors, including:

- The size and scope of your business

- your industry and level of cyber risk

- Your cybersecurity measures and incident response capabilities

- Past claims history and overall risk management practices

While it’s crucial to assess your own risk factors, it’s also critically important to recognize that insurers may have their own criteria for setting premiums. With cyber threats constantly evolving, it’s wise to stay informed and proactive in managing your cyber risk to perhaps lower your premium costs.

To Wrap It Up

As we navigate the ever-evolving landscape of cyber threats and insurance, it’s important to consider all aspects of risk management. Whether your high premium is a reflection of your own risk factors or those perceived by your insurer, staying informed and proactive is key.As we look towards Black Hat USA 2025 and beyond, let’s continue to work together to better understand and mitigate the risks that come with operating in a digitally interconnected world. Remember, in the world of cyber insurance, knowledge is power.