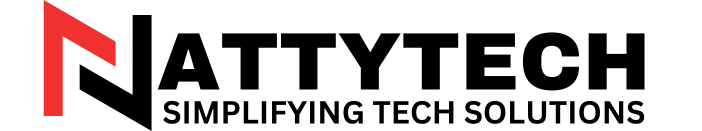

In the fast-paced world of finance, staying one step ahead of illicit activities like money laundering is crucial for maintaining integrity and trust. Thanks to advancements in technology, financial institutions now have a powerful ally in the fight against financial crime: open source intelligence (OSINT). From uncovering hidden connections to detecting suspicious patterns, OSINT provides financial institutions wiht a wealth of tools to combat money laundering effectively. In this article, we will explore five key ways in which OSINT empowers financial institutions to safeguard their operations and protect against unlawful activities.

Utilizing Open Source Intelligence for Enhanced Risk Assessment

Financial institutions are increasingly turning to Open source Intelligence (OSINT) to enhance their risk assessment processes and combat money laundering. There are five key ways in which OSINT can help in this fight:

- Enhanced Due Diligence: By utilizing OSINT, financial institutions can gather publicly available details on individuals and entities to conduct more thorough due diligence checks.

- Transaction Monitoring: OSINT tools can be used to monitor and analyze transactions in real-time, helping to identify suspicious activities and potential money laundering schemes.

- Behavioral Analysis: By analyzing online behavior and social media activity, financial institutions can gain valuable insights into the behavior patterns of their customers, helping to detect unusual activities.

- Geospatial Analysis: OSINT can provide geospatial data that can be used to track the movement of funds and identify high-risk areas for money laundering activities.

- Compliance Monitoring: Financial institutions can use OSINT to stay up-to-date on regulatory changes and compliance requirements, ensuring that they remain compliant with anti-money laundering laws.

Effective Monitoring of Transactions through OSINT Integration in Financial Institutions

Financial institutions play a crucial role in preventing money laundering, and one powerful tool they can utilize is OSINT integration. By harnessing the power of Open Source Intelligence, institutions can enhance their transaction monitoring capabilities and detect suspicious activities more effectively. Some key ways OSINT helps in this fight include:

- Enhanced data Collection: OSINT provides access to a vast amount of publicly available information, allowing financial institutions to gather data from a wide range of sources.

- Improved Risk Assessment: By analyzing data from social media, news articles, and other sources, institutions can better assess the risk associated with different transactions and entities.

- Real-time Monitoring: OSINT tools enable institutions to monitor transactions in real-time, allowing them to quickly identify and investigate suspicious activities.

- Cross-referencing Information: OSINT integration allows institutions to cross-reference transaction data with external sources, helping them identify patterns and connections that may indicate money laundering.

- Compliance with Regulations: By utilizing OSINT tools,financial institutions can better adhere to regulatory requirements and ensure they are taking the necessary steps to combat money laundering.

To wrap It Up

OSINT is a valuable tool for financial institutions in their ongoing battle against money laundering.By utilizing open source intelligence,banks and other organizations can gather valuable insights,monitor risks,and detect suspicious activity more effectively. With the ever-evolving landscape of financial crime, integrating OSINT into anti-money laundering efforts is crucial for staying ahead of illicit activities. By harnessing the power of OSINT, financial institutions can protect themselves and their customers from the dangers of money laundering, ultimately working towards a safer and more secure financial system.